high iv stocks nse

27 rows Create a stock screen. Adani Ports Special Economic Z.

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What is considered to be a high Implied Volatility Percent Rank.

. Option Screener with High Implied Volatility - NSE. StocksShares Trading at 52 Week High in NSE. From the best bid-ask prices of NIFTY Options contracts a volatility figure is calculated which indicates the expected market volatility over the next 30 calendar days.

Get a complete list of stocks that have touched their 52 week highs during the day on NSE. Low PCR Open Interest. These are stocks that can be bought and sold without much difference in the values.

Last-8-days-with-last-5-minute-15-x-50-above - Observe price crossing above ema or sma for. High Put Call Ratio Volume. India VIX uses the computation methodology of CBOE with suitable amendments to adapt to the NIFTY.

High Implied Volatility Call Options 26052022. Digital world acquisition corp com. Liquid stocks on the NSE consist of stocks that have traded in high volumes or high values on a given day.

Highest Implied Volatility Options. Our Financial Advisors Offer a Wealth of Knowledge. Find a Dedicated Financial Advisor Now.

High Implied Volatility Put Options Expiry 30062022. Higher Implied Volatility Suggest traders are actively trading At this strike Price. Position UnWinding- Call Option.

20 rows This can show the list of option contract carries very high and low implied volatility. Ad Experienced International Investments Team. Short Covering - Call Option.

10 25 50 100 All. Indian Energy Exchange Ltd. The stocks volatility for the past 20 days and the past 1 year is based on the stocks actual price movements.

Call Option Most Traded. This will make the process much easier and depending on the brokerage may even allow you to place orders from within your scanner. The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles.

Position Build Up- Call Option. High Implied Volatility Call Options Expiry 30062022. Low Put Call Ratio Volume.

India VIX is a volatility index based on the NIFTY Index Option prices. Ad Put Your Investment Plans Into Action With Personalized Tools. Download csv As on IST.

Run queries on 10 years of financial data. High Implied Volatility Put Options 30062022. Iv rank iv percentile top 20 on wsb.

Most Active Contracts Most Active Future Contracts Most Active Option Contracts Most Active Calls Most Active Puts Most Active Contracts by OI. Ad Ensure Your Investments Align with Your Goals. A Concentrated High Conviction Portfolio Of 30 International Large Cap And Mid Cap Stocks.

Open an Account Today. High Implied Volatility. Scan the stocks and see if these reversals are happening at low volume nodes to see if there is clear rejection of the level.

The best way to start scanning for high implied volatility will be through the broker that you trade with. Short Build Up- Call Option. Hourly pivot reversal - Wick reversal extreme reversal outside reversal and doji reversal.

52 week high 52 week low prices are adjusted for Bonus Split Rights Corporate actions. Awesome dual golden buy sell filter in one -. Thu Apr 21st 2022.

Different brokers have varying levels of sophistication so choose wisely. Cassava sciences inc com. Mother candle buy 120min - Mother candle 120 by alfa capital.

Searching for Financial Security. Higher Implied Volatility Suggest traders are actively trading At this strike Price. FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month expiry date 26052022.

Option Screener with High Implied Volatility - NSE. S1 breakout with volume - - stocks that have seen an sudden rise in their volume by over 2x times the average volume over the past 10 trading sessions and have gained or lost more than 5 today. A green implied volatility means it is increasing compared to.

It can help trader to find the strike to buy or sell. View stocks with Elevated or Subdued implied volatility IV relative to historical levels. In contrast the implied volatility is derived from options.

High Implied Volatility Put Options 26052022. The upper and lower price bands for scrips on which derivative products are available or scrips included in indices on which derivative products are available are. Arquit quantum inc com.

One Of The Highest AnalystCompany Ratio. It highlights Stocks ETFs and Indices with high overall callput volume along with their at-the-money Average IV Rank and IV Percentile. Highlights heightened IV strikes which may be covered call cash secured put or spread candidates to take advantage of inflated option premiums.

High Implied Volatility Call Options 30062022. FO - Listing of Stock With High Put Options Implied Volatility for Indian Stocks near month expiry date 26052022. High Implied Volatility Put.

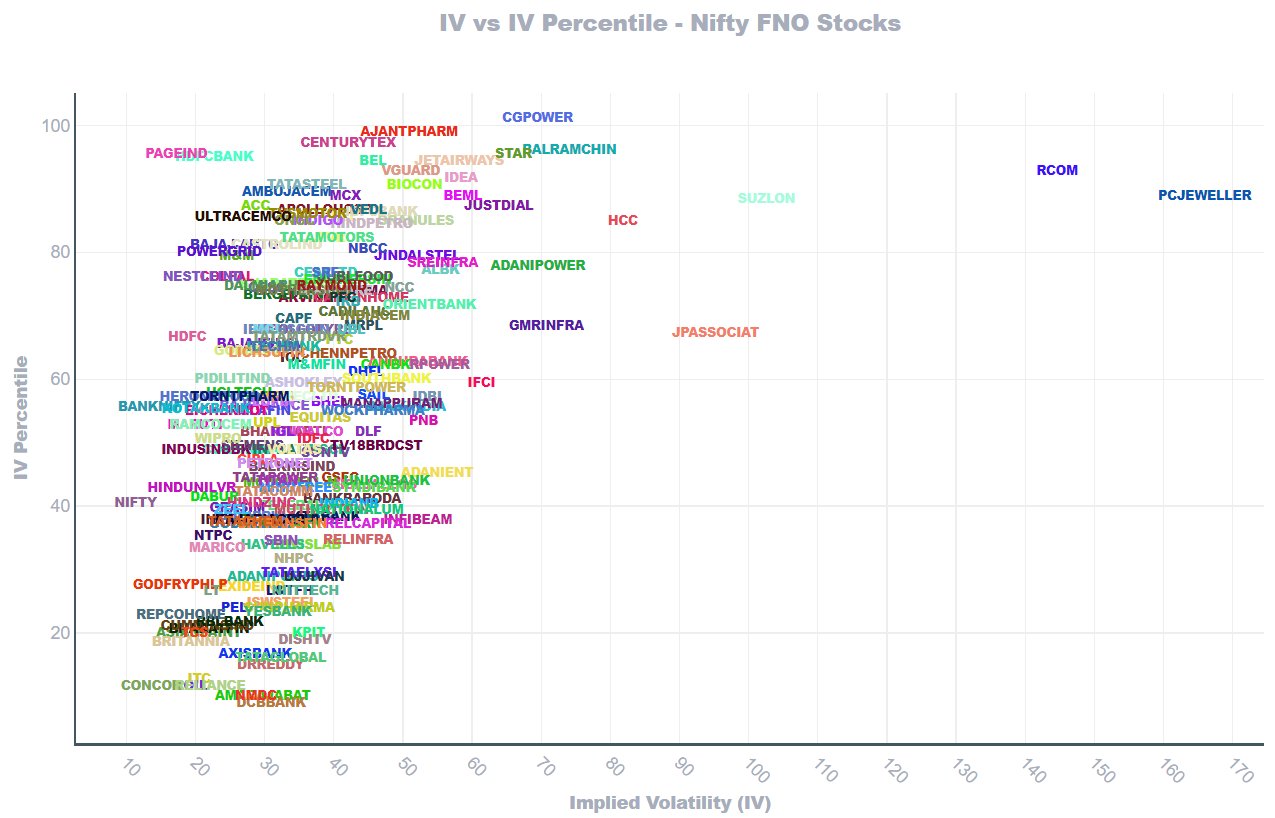

Raghunath On Twitter Inspired From Mrechenthin Iv Vs Iv Rank Visualization Chart I Made A Similar Chart For Nse Fno Stocks I Made Both Iv Vs Iv Rank And Iv Vs Iv

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

How High Is High The Iv Percentile By Sensibull Medium

Stock Market News Research Panel Investment Advisers Stock Market News Indiabulls Real Estate Up 5 M Stock Market India Stock Market Marketing

Iv Percentile Vs Iv Rank Ivp Vs Ivr In Options Trading Stockmaniacs

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Where Can I Find An Iv Chart Implied Volatility For Free Quora

Nifty Reacted Higher Perfectly From Blue Box Area Blue Box Stock Market Nifty

Nifty Midcap Index Elliott Wave Analysis Buying Opportunity Soon Analysis Waves Elliott

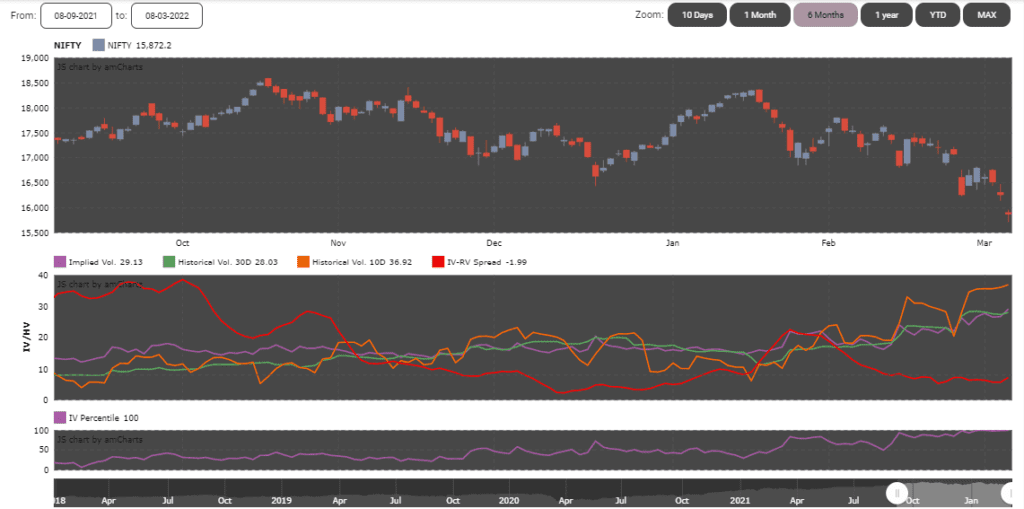

Hv Iv Options Indicator Muthu S By Muthushun Tradingview India

Raghunath On Twitter Inspired From Mrechenthin Iv Vs Iv Rank Visualization Chart I Made A Similar Chart For Nse Fno Stocks I Made Both Iv Vs Iv Rank And Iv Vs Iv

Where Can I Find An Iv Chart Implied Volatility For Free Quora

Michael Hart On Twitter Trading Charts Options Trading Strategies Option Strategies

Nifty Shorts Via Puts Http Bit Ly 3xebqad Priceaction Elliottwave Trendonomics In 2022 Nifty Waves Elliott

Renee Parent On Twitter Tastyworks Option Traders Https T Co F1rfn8pmyl Twitter Stock Options Trading Online Stock Trading Options Trading Strategies

Impliedvolatility Indicators And Signals Tradingview